Terence Corcoran reports in the National Post on Friday, January 16, 2009 that the STIMULUS everyone is yelling for may only work over a short period and may actually MAKE THE ECONOMY WORSE over longer periods.

[Read the article below for the researchers who studied this phenomenon.]

POINTS

- "What if, as a wide and growing school of economists now suspect, the government spending and stimulus theory is a crock that is shovel-ready to be heaved out into the barnyard of economic waste?"

- Even disciples of Keynes, such as Harvard's Greg Mankiw, recently highlighted economic studies that show government spending binges -- shocks, they are sometimes called -- don't seem to help the economy grow. They might even make it worse.

-One of the studies cited by Mr. Mankiw was by two European economists (Andrew Mountford and Harald Uhlig), titled "What are the Effects of Fiscal Shocks?" It looked at big deficit-financed spending increases and found that they stimulate the economy for the first year, but "only weakly" compared with a deficit financed tax cut. The overriding problem is that the deficits crowd out private investment and, over the long run, may make the economy worse. "The resulting higher debt burdens may have long-term consequences which are far worse than the short-term increase in GDP."

-A paper by two economists, including the current chief economist at the International Monetary Fund, Olivier Blanchard, concluded that increased taxes and "increases in government spending have a strong negative effect on private investment spending."

-Roberto Perotti, an Italian economist with links to Columbia University, in "Estimating the Effects of Fiscal Policy in OECD Countries," found nothing but bad news for Keynesians. Economic growth is little changed after big increases in government spending, but there are signs of weakening private investment.

- What we all might logically intuit to be true -- spend government money, especially borrowed money, and you stimulate growth -- has long been thought to be a fallacy by some economists. That thought is now spreading. British economist William Buiter said the massive Obama fiscal stimulus proposals "are afflicted by the Keynesian fallacy on steroids."

The whole article by Terrance Corcoran follows:

Are you "shovel-ready," poised to hit the ground running, or merely desperate for cheap cash to get through the recession? If so, here's your last chance to apply to Ottawa for a piece of the massive government spending-bailout-infrastructure-stimulus operation now being prepared for Finance Minister Jim Flaherty's Jan. 27 budget extravaganza.

To get you going, the National Post has created an all-purpose Stimulus Canada application document. Simply make sure your company/institution fills out the form here to get in on the action.

We're just kidding, of course, or at least we were until our satirical Stimulus Canada General Application Form was mugged by reality, which is rapidly turning out to be funnier than the fanciful idea of a government department called Stimulus Canada. To all intents and purposes, Stimulus Canada already exists.

Government money to flow, the taps are opening, deficits are no problem. The spending, as Stephen Harper said after a meeting with the premiers on Friday, will be "very significant" and there will be "very significant deficits." That could mean new spending of $20-billion and deficits of $40-billion.

Industry groups, corporate opportunists, charities, municipal politicians, arts groups, provincial premiers, tech firms, mining companies, forestry operators, banks, money lenders -- in fact, just about everybody has come forward to get in on Canada's portion of what is turning out to be a mad global government stimulus pandemic.

Each claims to have a plan or an idea that they say would produce jobs, spending, investment and activity that would get Canada through the recession and stimulate the economy.

At some point, though, the clamour of claims and calls becomes absurd, and that point looks to have been crossed the other day in the United States when porn merchant Larry Flint said the U.S. sex industry was falling on hard times, business was down 25%, and it needed a $5-billion slice of the $1.2-billion U.S. stimulus program.

And why not?

Mr. Flint has a point. It is not totally illogical for anyone to think that way. If you spend a dollar somewhere -- whether building a bridge or operating a forest company or buying a car -- it generates activity. And, after all, it's a grand old economic theory, created by John Maynard Keynes, that spending, especially government spending, rolls through the economy on a giant multiplier, piling jobs on jobs, growth on growth.

Except for one problem: What if it's not true? What if, as a wide and growing school of economists now suspect, the government spending and stimulus theory is a crock that is shovel-ready to be heaved out into the barnyard of economic waste?

The Prime Minister, in his comments on Friday, seemed to be riding right into the barnyard. He said the government would be simply "borrowing money that is not being used" and "that business is afraid to invest." By borrowing that money, and turning it over to all the groups and interests looking for part of the stimulus spending, he would be jump-starting activity while the private sector got its legs back.

Even disciples of Keynes, such as Harvard's Greg Mankiw, recently highlighted economic studies that show government spending binges -- shocks, they are sometimes called -- don't seem to help the economy grow. They might even make it worse.

One of the studies cited by Mr. Mankiw was by two European economists (Andrew Mountford and Harald Uhlig), titled "What are the Effects of Fiscal Shocks?" It looked at big deficit-financed spending increases and found that they stimulate the economy for the first year, but "only weakly" compared with a deficit financed tax cut. The overriding problem is that the deficits crowd out private investment and, over the long run, may make the economy worse. "The resulting higher debt burdens may have long-term consequences which are far worse than the short-term increase in GDP."

Two other studies point in the same direction. A paper by two economists, including the current chief economist at the International Monetary Fund, Olivier Blanchard, concluded that increased taxes and "increases in government spending have a strong negative effect on private investment spending."

Roberto Perotti, an Italian economist with links to Columbia University, in "Estimating the Effects of Fiscal Policy in OECD Countries," found nothing but bad news for Keynesians. Economic growth is little changed after big increases in government spending, but there are signs of weakening private investment.

What we all might logically intuit to be true -- spend government money, especially borrowed money, and you stimulate growth -- has long been thought to be a fallacy by some economists. That thought is now spreading. British economist William Buiter said the massive Obama fiscal stimulus proposals "are afflicted by the Keynesian fallacy on steroids."

Over at Stimulus Canada, Mr. Harper's plan looks somewhat more modest and Canada is not in the same fiscal fix as the United States. But Ottawa and the provinces are clearly ready to borrow big wads of money from the future to stimulate the economy today. It's money that is supposedly sitting out there in the timid hands of investors who will be repaid with tax dollars later.

But if that stimulus spending does not generate much fresh economic growth, and the borrowing chews up money that private investors could invest in the future, the shovel-ready brigades who get the cash today will produce only short term gains at the expense of the long term health of the economy.

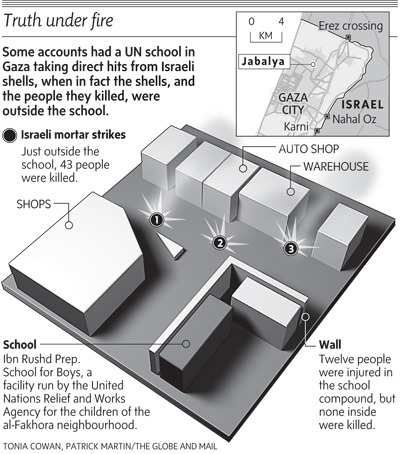

unproven allegations. But an in-depth investigative report by the Globe and Mail's Middle East correspondent, Patrick Martin

unproven allegations. But an in-depth investigative report by the Globe and Mail's Middle East correspondent, Patrick Martin  Stories of one or more shells landing inside the schoolyard were inaccurate.

Stories of one or more shells landing inside the schoolyard were inaccurate.

No comments:

Post a Comment